We ll send instructions once your ira is open.

Open roth ira vanguard vs fidelity.

First contributed directly to the roth ira.

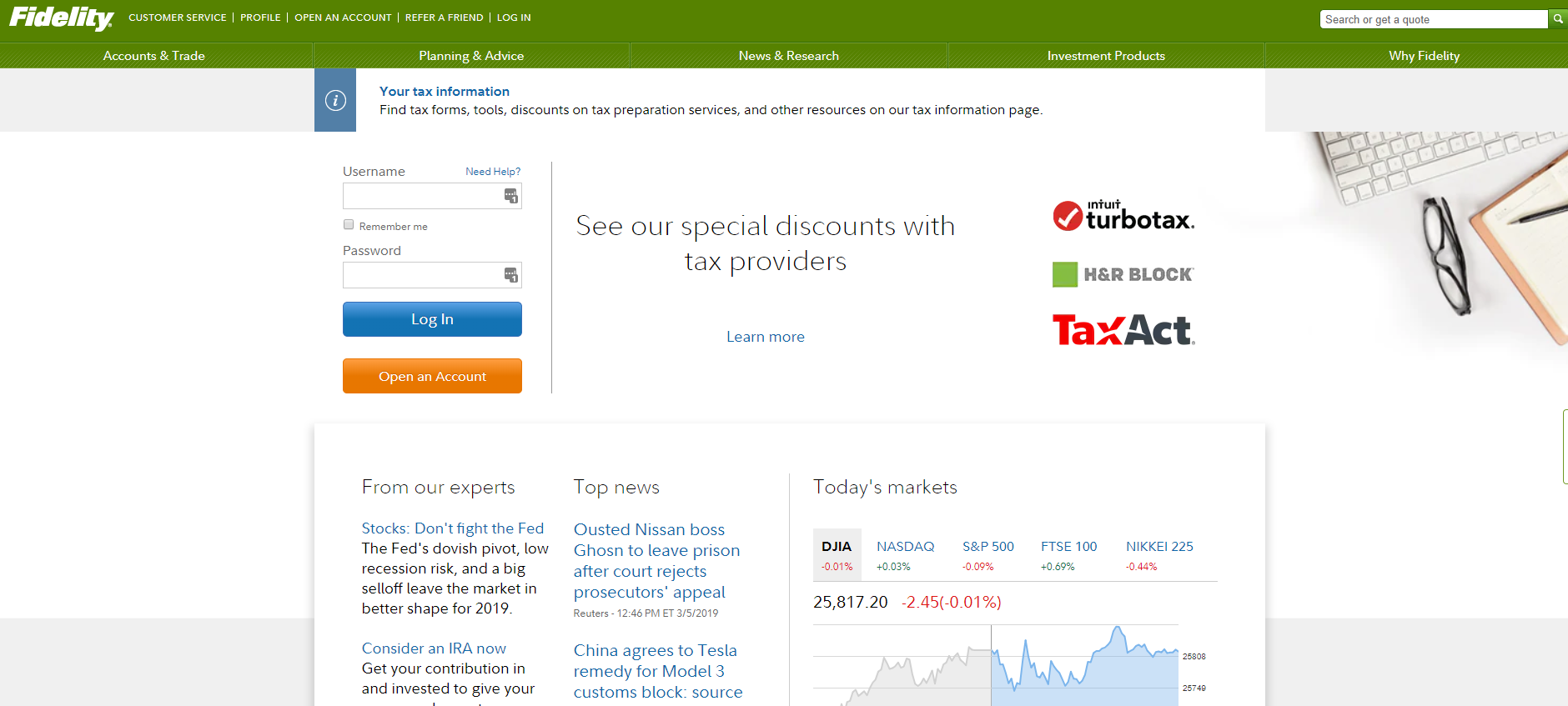

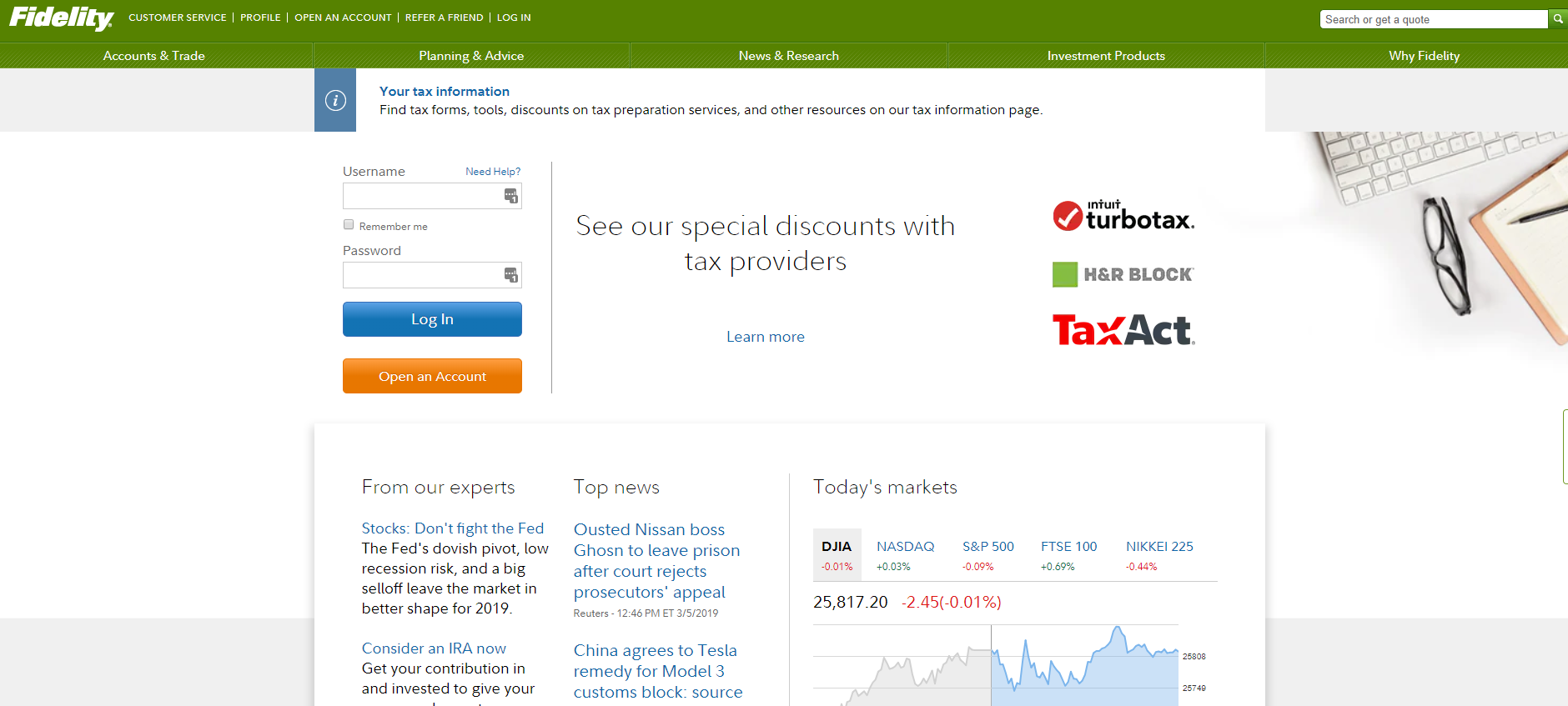

Fidelity doesn t have an annual maintenance fee or inactivity fee.

Name beneficiaries for your ira.

The custodian maintains control of the child s roth ira including decisions.

As of 2019 fidelity boasts 30 million individual investors and 8 3 trillion in total customer assets while.

If you re under age 59 and you have one roth ira that holds proceeds from multiple conversions you re required to keep track of the 5 year holding period for each conversion separately.

Converted a traditional ira to the roth ira.

Open a roth ira from the 1 ira provider fidelity.

Move money directly from your bank to your new vanguard ira electronically.

Furthermore as with a regular brokerage account vanguard imposes a 20 charge if a vanguard mutual fund has a balance less than 10 000.

A fidelity ira has no set up fee no annual fee and no maintenance fee.

There are many similarities between fidelity and vanguard.

A vanguard ira does have a 20 annual fee.

Fidelity and vanguard are two of the largest investment companies in the world.

Open your ira online quickly easily.

Both brokerages charge low fees and offer investment accounts for you and your family.

Minors cannot generally open brokerage accounts in their own name until they are 18 so a roth ira for kids requires an adult to serve as custodian.

Get started with as little as 1 000.

Vanguard iras have an avoidable annual account service fee.

You can avoid vanguard s fee by keeping at least 10 000 invested in.

Rolled over a roth 401 k or roth 403 b to the roth ira.

Fidelity even offers term life insurance.

Investors who prefer vanguard s funds may be better off going that route while fidelity loyalists would be wise to open an account with fidelity as it offers inexpensive and free ways to invest.

An ira can be opened at either broker with 0.

You ll just need your bank account and routing numbers found on your bank checks.